Gold as a Proof of Stake in Violence

Some mythology of hard money for the dawn of cryptocurrency

Commodities are fetishized throughout history and become the objects of profound myths. Among these, none more than money. Among moneys, none more than gold.

The social meanings and the mythologies of money are altering and evolving under exposure to the hype and drama around contemporary cryptocurrency. For the sake of golden Midas and fiery Surtr, and for their living sons who may prefer not to be named — and for the sake of dazzling Taylor Swift and langorous Lana del Rey, or the mythic archetypes they represent, best left implicit — for these, this changing mythology of riches deserves some attention.

The relative value propositions and the social promises of cryptocurrencies hinge on properties of their protocols: distribution, consistency, immutability, decentralization, anonymity, proof of work, proof of stake, so on.

New cryptocurrencies are cast in contrast to past currencies, but the contrast is often underdeveloped. If Bitcoin is synonymous with proof of work and Ethereum is now synonymous with proof of stake, both are positioned in contrast to fiat paper currency and in contrast to precious metals. The fiat currencies’ protocols are bureaucratic and legally defined. The precious metals’ protocols are “natural” or “customary”, which is to say: obscure and taken for granted.

What are these obscure implicit protocols for precious metals? The “chain” for this protocol is simply the present traces of the history of how matter has been distributed in space and time, i.e., material world history. And all “trade” in precious metals in spacetime is an abstraction on top of physical motion and force.

Examining the number of on-chain=in-world invocations of various functions of the implicit force-motion protocol throughout world history, forceful appropriations of precious metals often account for more of the in-world transaction volume in a given era than any allegedly-normative “trade”.

Trade is just one particular socially-mediated meta-protocol implemented on top of the fundamental force-motion protocol, and not always the dominant one.

Property, Provocation, and Protection (A security paradox is the point)

As it first appears in childhood socialization and in early mythology, gold is flashy. Gold inspires jealousy. Gold is high-status ornamentation; gold jewelry extends the body but is tearable from the body; gold never tarnishes; gold is the Sun among metals and silver the Moon; dragons mass gold where they sleep and gather it by swooping down wherever they see prey with its glint. Divers must not wear silver while swimming among barracuda.

Precious metals held close to the person, openly and in view, are a fundamental prototype, a paradigm, of marginally socially legitimate, marginally secure, marginally recognized personal property. They are proofs of social power and social order and also temptations to break that power and order. Everyone who has enjoyed watching a flashy gangster movie has vicariously sensed the excitement of walking this dangerous line of signaling invulnerability by signaling open vulnerability. A thick gold chain or a fat diamond pin is a proof of stake in the local system of violence… right up until someone provides a counterproof in the form of a beating, a shooting, or a robbery.

This provocative protocol is deprecated in the middle classes, where proof of stake in violence can be checked more elegantly via the politics of citizenship and policing. It is gauche to flaunt precious metals in societies where primitive accumulation has been buried in the past and at the economic margins. Yet the few exceptional institutions of the middle classes that still use gold in core symbolism maintain evidence of this violent original nature, such as the gold wedding band that signals the bonds of personal mutual protection and socially legitimated physical coercion that were until recently still implicit in middle class marriage. (And it is arguable whether middle class marriage is surviving the removal of this trace of violence, where it is removed.)

In upper classes, the protocol is not deprecated but it is complicated. The tradition of aristocratic ransom, for instance, as so frequently found among the knights of the Middle Ages or in the famous story of Caesar among the pirates, takes the use of gold to simultaneously provoke and prevent violence to another level of social extension. Entire close-knit families can be extorted as a whole through their most vulnerable members, yet entire families can also prove their capacity for unified retaliation to avenge their vulnerable members when wronged. Corporate ownership of precious metals becomes conceptually obvious and socially feasible given corporate organization of violence.

This is a fitting new mythology for Surtr’s sons in war and for Lana’s listeners who feel born to die: the social property protocols for precious metal transfers always originated intertwined with the social protocols for provoking, negating, organizing, and legitimating violence.

For Bitcoin and Ethereum: sustained ownership of these cryptocurrencies implicitly proves stake and work in cybersecurity as well as proving work or stake in the formal protocols. For early adopters these cybersecurity signals have been particularly strong and important. They account for some of the gangster chutzpah popular among otherwise pasty, anxious early giants of the field.

States with Veins of Gold (Currency is theft)

The most iconic corporate owner of precious metals is the despotic ancient state. According to one branch of contemporary political mythology, these states were born to administrate the storage and distribution of golden-brown agricultural grains: state currency emerged as a tokenization of protocols for the rationing of fungible cereals. Regardless of the truth or untruth of this particular origin myth, taxation of farmers in currency has complemented forced agricultural trade in currency in many ages in many polities, even into the present.

A state with agricultural territory and control of violence in the territory will commit to some limited safekeeping of its subjects. Proof of the subjects’ conditional safety comes from their ability to keep personal stores of precious metals, stores that they use to conduct taxed trade throughout the territory. In times of war, the state will levy additional taxes, taking precious metals from the populace according to its desire to pay and equip new soldiers. For most if not all of history, a commoner’s ownership of any precious metals has been always at risk of interruption by both marauding brigands or pillagers and also a sovereign’s taxes to fund violent action against marauders and rivals.

The sovereign who wears precious metals and jewels thereby proves his personal security while the one whose subjects own precious metals and jewels thereby proves his territorial security. The famous formula of “the king’s two bodies”, i.e., the physical body and the body politic, composes seamlessly with the formula of adornment of the physical body as a valuable proof of stake in violence. This pattern also extends through the cybersecurity analogy for Bitcoin and Ethereum: crypto communities nucleate and grow around the cybersecurity experts and platform providers who help set up commonly-used wallets, nodes, and protocols for others.

The mythology of the Bronze Age, always vital and today hotly contested, provides additional examples of the implicit protocols and their origins.

The royal messenger carries a gold seal in part to prove that he came truly on official channels: without the security of the official channel, the gold seal could never have been carried safely. Traveling with the gold is a proof of royal security work.

The ability to cast gold and the ability to cast bronze are not dissimilar. For high quality, both require mastery of alloys and molds and central positions in extended trade networks. An ability to have custom gold work done proved integration into trade networks homologous to the weapons trade: it functioned as a sort of proof of mercantile API key.

Finally, when gold is self-secured property then the taste for flaunting gold is a taste for exposure to violence and for self-owned space. A strong taste for showing gold in the governing class showed a taste for heightened risk and responsibility, a taste for glory. Those who keep all their gold in hardened vaults may be stagnating misers, but those who flaunt it and distribute it to their companions invite challenges and opportunities. The different tastes for gold thereby become classifying markers of stingy and generous leadership classes, the Saturnine and Jovian archetypes of the Ancient and Renaissance astrological traditions that still shape modern antipathies between bureaucrats and entrepreneurs, the contemporary Guelphs and Ghibellines.

The state has never just been based on a single secret founding murder of an other, a la Girardian tradition, but also on prominent, regular, and repeated murders of all those who would interfere with its territorial security or its attempted monopoly on expropriation in its territory. Precious mineral ornamentation of the body politic is proof of this murderous habit. The establishment of a metallic currency is always tied to the capacity to openly kill and to openly take by force in a territory.

For the would-be Midas: everything has been turned to gold when everything can be threatened to extract new taxes from those who value it. Crypto ransomware and browser miner hackers prove an analogy: every sufficiently general computing process can be made to generate crypto when it’s insufficiently secured.

Stars Above (Sovereignty is conserved at zero)

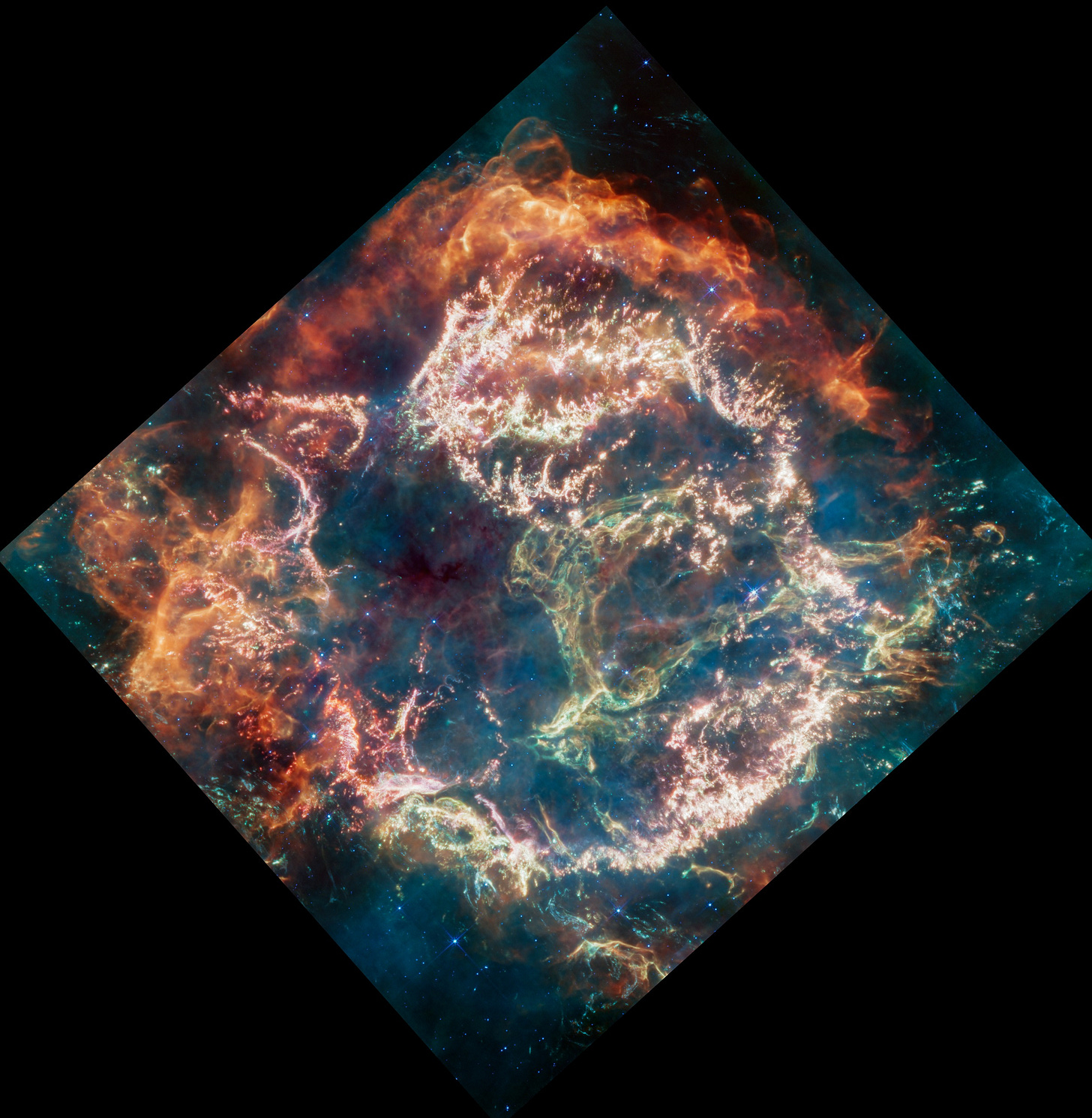

While states and kings can mint gold coin or decree standards like the pound, livre, florin, or libra for their currency, the fundamental unit of gold is the atomic nucleus with 79 protons: a basic chemical token minted in supernovae, the most physically violent events currently known in the cosmos.

No political power can mint new gold atoms short of rivaling the most potent stellar catastrophes for power density. The integrity of a gold standard is ensured by this separation in scale between terrestrial and stellar physics. Until the time that human industry intensity rivals the intensity of supernovae, the amount of gold available is practically limited by how deeply we can dig for its ores — depth in the Earth’s mines or depth in the sky starting from the asteroid belt — and then by how thoroughly we can purify gold atoms from even the thinnest ores.

The accumulation of gold, then, is a symbolic epitome of one pessimistic vision of all animal life: shells of cold dust multiplying themselves on appropriated sunlight, compost worms writhing in stellar excretions.

Less brutally, but perhaps more shamefully: gold is a coinage metal, valuable to us, like copper and silver, because it is among the few metals that the air and water and ambient life will not steal directly from out of our hands. The Jungian Shadow of gold as a proof of stake in human violence is our species’s powerless acceptance of the corrosion and decay of so much else: no pretense of human, political “monopoly on violence” has ever held against wind and wave, salt or plague.

Gold is an exceptional resource that seemingly keeps its quality and quantity without skilled maintenance and renewal. Stones such as flints, shells, ceramics, and gems are other low-maintenance goods that have also served as important currencies at one time or another. Mining gold, like mining copper or silver or quarrying marble or collecting gems, expands a lasting pool of readily available resources that at least appear to stay in human hands rather than returning quickly to anonymous depths of nature through rust or rot.

The expansion of this pool is easily made into a mythic sign of progressive improvement of the world, and further a proof of our species’s mastery of nature. Yet only humans compete for gold and stones. There are not dragons. This “mastery” is the self-satisfaction of the little boy who has run off to make his own game after one too many lost scrapes among the other kids.

Control over the alternative star-minted tokens carbon and nitrogen would be much more impressive, but there we have no comparison to the bacteria, which outmass us over one hundred to one, or even the fish, which outmass us ten to one. We can claim control by claiming our minds order the territories of “simpler life”… but then the gut soon rumbles with its trillions of tiny passengers whose secretions guide and materially constitute some of our deepest, most compelling feelings of desire and disgust.

In an analogous manner, cryptocurrency often remains unimpressive to those with stakes in blunter local monopolies on physical violence. There are only so many mysterious deaths of crypto mavens in Honduras or Puerto Rico that you can notice before you get the point that holding on to crypto doesn’t necessarily prove your immunity to blunter violence any more than holding on to gold has proven kings invulnerable to time or disease. Dazzling young ingenues have always called old misers’ Midas bluffs that precious metals could be absolutely preferable to fresh health and natural beauty; Taylor Swift is a banker’s daughter.

Yet still, for exactly these reasons, cryptocurrency might prove a store of lasting value after all: it would be the store of value uniquely complementary to the privilege escalations, hash cracks, and other power plays among disembodied, anonymous computational phantoms avoiding direct physical competition. As with gold and biological power networks: by being least valuable to certain incumbent human power networks, cryptocurrency might more robustly constitute the veins of new computational power networks.

The Path through Fiat (Homo erectus to homo larvatus)

The analogies between precious metals and cryptocurrencies so far can be fibered through fiat currencies as well. Where gold is proof of stake in systems of bare physical security and cryptocurrency is proof of stake in systems of cybersecurity, fiat currency has served as proof of stake in systems of legal security.

Albert O. Hirschman’s short, insightful The Passions and the Interests cites Montesquieu’s key detail on how the early bourgeoisie used bank notes to decouple from feudal politics by sidestepping physical threats:

through this means commerce could elude violence, and maintain itself everywhere; for the richest trader had only invisible wealth which could be sent everywhere without leaving any trace… (The Passions and the Interests (Princeton Classics Edition, p. 72), quoting Montesquieu, Esprit de Lois (Book XXI))

By this means commerce could elude many local forms of violence, but not the legal violence of the reigning political orders. The invisible wealth could not truly be sent just anywhere but only where banking institutions secured private, local restrictions on violence within their own networks of linked branch premises — always state-sanctioned, state-integrated, and state-taxed.

These networks came to seem omnipresent in Europe due to the industrious work of pioneering Italian bankers, but in the earlier days of the Templar it was all too clear how limited they began (and how dependent on uncertain state sanction). The extension of credit instruments and paper currency through a society analogizes to the extension of precious metal ownership, and like expanding metals ownership indicates expanding physical security, expanding fiat credit indicates expanding legal security: security of identity and security of contract.

Like gold, paper money represents a retreat from storing value in instruments that cannot be held easily due to base environmental competition, but in contrast, this fiat currency retreats from gold to escape a background of base human competition rather than base animal competition. It marks and constitutes the bourgeois’s moral separation from less “gentle”, less legally-privileged classes.

The move from paper currency to cryptocurrency is similarly beginning against an imagined background of unfair competition, a new propagandistic model of the viciousness of non-computational classes emphasizing alternately “taxation as theft by parasitic Paper Belt overclass” and “democratic mob risks to centralized banking” and many other concerns in between.

The proverbial Protestant ethic of disdain for flashy show of material wealth in favor of subtler moral wealth, Max Weber’s “worldly asceticism”, is now mirrored in the HODLer’s diamond-handed disdain for state-defined fiat currencies in favor of bitcoin. The Christian martyr ethic successfully decoupled physical beatings from low social status (at least in the community’s own estimation), giving the Protestant ethic some unique resources to accept disprivilege in systems of bare physical violence and thereby prioritize privilege in systems of legal violence. An American Libertarian martyr ethic decouples legal penalties and precarities from low social status, giving crypto proponents courage and solidarity in the face of regulatory uncertainty and electoral weakness.

Whether the Libertarians will thereby amass privilege in the domain of cyberinfrastructure, like the Puritans, Episcopals, and Quakers once amassed privilege in American legal infrastructure, remains to be seen. Early indications seem to support the prediction.

Gold Standards in Symbolic Exchange (Fool’s gold, sophomore’s gold)

This essay so far has been loosely resonant with the styles, tones, and rhythms of 2009–2015-era neoreactionary (NRx) bloggers who shaped early political discussion of crypto and who were braving popular censure to advocate Exit from less computationalist, more humanist status dynamics. So far it might not sound too out of place as a blog post in that right-cyberpunk melange that would inspire later cryptocurrency quasi-celebrities Balaji Srinivasan and Charlotte Fang.

Does this style still have currency?

In retrospect since 2019, the whole movement seems embarrassingly downstream of Epstein and Brockman and the “Reality Club” that preceded the short-hyped “Intellectual Dark Web.” And Asimov’s The Sensuous Dirty Old Man now seems to be essential to that memetic current rather than a stray accidental sideline. See Donald Barr’s Space Relations and the last Dune books.

The style is punky and reference-heavy. It uses rough edges and aggressive “did you get it, are you one of us” references. In their typical hybrid jargon of quasi-academic neologism and informal slang, the neoreactionaries once called these “exosemantic gang signs”.

The antics could seem clever from afar but proved sloppy close up. Few of NRx’s advocates of patriarchy could reliably distinguish that from puerarchy: rule by the little boys, rule by the most fun playtime friends with the nastiest anime porn, rule by whoever would allow them to stay up latest on their computers playing 4X games or doing party drugs together. “Dark elves”, in other words.

For a time, the puerility was the point. Using these symbols proved willingness to dare a particular kind of censure, to dare particular kinds of exposure to more rough-and-tumble discourse. A sort of proof of intellectual security within a system of competitive humiliation; a masculine complement to challenging puellile feminist rhetoric about “drinking white men’s tears”. More levelheaded and mature prose styles might be more valuable for other applications, but those styles couldn’t prove personal social powers of the same kind on the same fields of status competition.

Even when 2010s online movement exemplars such as Nick Land or Sarah Jeong had deep and widely respectable intellectual roots, their public styles were not chosen to emphasize this and thus prove creditworthiness in more traditional trust networks. Instead these styles embodied intransigent determination to set new terms for trust and credit. They often succeeded.

Given a new mythology of precious metals a golden style might not mean a timeless, shining style: a golden style might mean one that dares envy, exposure, and attack.

On the Internet since the heydays of 4chan and SomethingAwful (and perhaps culminating in Trump’s Twitter), only directly risking and participating in blunter humiliation dynamics seems to prove personal online rhetorical security. But in the strongholds of the academy itself, well before the mass Internet, provocateurs of postmodernism such as Lacan, Derrida, and Baudrillard had already succeeded in decisive raids on the traditional vaults of intellectual symbolic exchange value. One could go further to trace back-and-forth fluctuations in personal and traditional control of symbolic exchange values that were just as extreme for centuries beforehand. That trace only ends where decipherable history ends.

As with physical gold, symbolic-gold hoarders always exist in aggressive dynamic tension with symbolic-gold flaunters. The Saturn and Jupiter archetypes originated in the play of roles as old and as fundamental as tribal agriculture. They are lindy. They are robust to underlying technology: they symbolize the fundamental strategic tradeoffs in risk management prioritizing stability or antifragility.

Yet if we’re talking about puerility and deconstruction, there’s also a third archetype appearing here, on cue to deliver an open-ended, playful inconclusion: the eternal boy, trickster, and messenger: Mercury, Hermes, a god of commerce and of thieves.

’Tis Death to Counterfeit! (No such thing as a stolen lunch)

In commerce and in theft, sometimes one’s own perceived risk is another’s secret certainty and sometimes one’s own certainty is another’s risky confidence trick.

The transcendental trouble with formalizing norms for subjective epistemologies in the face of adversariality is that opponents have every incentive to wreck one’s ability to define any observation set A or B before one can even begin to approach the probabilities P(A), P(B), P(A|B), or any of the rest of that formal machinery of the hypothetical ideal gambler called Bayesianism. These adversarial dynamics, from the stealthiest camouflages and invisibilities to the boldest prey mimicries of predators, have played through billions of years of evolutionary history and they consistently reinforce a central fact of subjective judgment: its dizzyingly recursive, intransigent fallibility.

One might put it this way: in practice, for every contested proposition A, there is an instance of not-A that can be confused for satisfying A. For every currency so far, there has been a convincing counterfeit, from gold to fiat to adenosine triphosphate, “energy currency of the cell”, which is mimicked by P2X and P2Y protein family receptor agonists, to glucose, “energy currency of the body,” mimicked by poisons and artificial sweeteners.

For every proof of stake in a system of violence, there is a convincing false assertion of stake in that same system: “force or fraud” goes the famous Machiavellian cynicism. And in crypto, cybersecurity is certainly as much a matter of fraud as force, with social engineering a la Mitnick just as practical as blunt overpowered botnets styled “Low Orbit Ion Cannons”.

In the other direction, currencies that seemingly prove stake in violence also suggest fraudulent threats. Anyone can put on a gold chain and start to act gangster. Anyone with enough fiat can start acting as if they’re also legally connected and could sue you if you cross them. Anyone with crypto can try to pretend they are in touch with scary genius hackers. Fake gold, fake money, and fake crypto can all work just as well for a bolder con artist. The bar isn’t reality, but just plausibility. Just enough plausibility to move the other before they can check reality (if they ever do at all).

A market by itself can never do all the work of distinguishing desired A from undesirable not-A, true value from false pretense. “Let the buyer beware” is a classic phrase copied pervasively, and investors always need to be on guard against false advertising. A market aggregates this work of discerning fraud rather than performing the work itself, and it is “efficient” only in the sense of delivering to each investor a portfolio of exactly the quality they can discern.

Markets, by themselves, are efficient at coalescing illusions of value rather than in sifting out the truths among the illusions. The death of illusions either by personal learning from loss or by social learning in the form of social humiliation and exclusion of the losers are the sifting mechanisms, and these are not market mechanisms but rather market society mechanisms.

On these terms, give the new guys some credit: crypto markets so far have done a fantastic job of coalescing illusions, and they have certainly enabled the pointed humiliation of some fraudulent losers.

The credulous losers have been a more sympathetic bunch, though, and this creates an issue for crypto: current governments don’t seem to believe general freedom to defraud the computationally naive is good for their countries. It undermines their provision of security of property for citizens and interferes with their prior plans for expropriating their own share of that property they secure.

Mythologically, Mercury is the messenger of Jupiter, not his lord or commander. Commerce circulates by the liberal grace of Jupiter while each accountant and tax collector enforces the stricter laws of Saturn. If the competition among currencies were only fiat currency versus cryptocurrency, proof of stake in legal force versus computational force, then it would be hard to see how crypto could prevail.

However, many holders of gold are skeptical of the fiat system, particularly the sustainability of US debt levels and efficiency of US government currency allocations, so the crypto versus fiat competition also brings in the elements of physical force. Computational innovations operate as new mediators, mercenaries, and spoilers between the systems of legal force and extralegal violence.

This is a pattern with promising precedents. In a similar way, the contemporary fiat system escaped from its subordinate relations to the gold system in the 1970s by putting its roots more directly into the carbon system: the dollar is now supported by oil more than gold.

Tying into the carbon system, however, has engaged deeper, darker commercial myths than those of Mercury. The frauds and thefts of these myths are less lighthearted. The Classical god of deep riches and deep fires is also a hoarder of souls most well-known for his abduction of a beloved daughter and for thus bringing about a climate catastrophe. This resonates with the fears of many anti-crypto activists today: if bitcoin mining burns deep gas and incentivizes ever more burning, is it just a global warming accelerant? Is it just a new currency for human trafficking?

There are not and cannot be straight answers to these questions yet, and there may never be. Most history is never written, and any history that is written is always subtly or blatantly shaped by contemporary myth.

Force and fraud will play out half in light and half in darkness, and rainbow auroras mixing impassioned intuition and half-assed opinion will continue to play over the gaps between our blackest ignorance and our brightest knowledge.

Thanks to all draft readers of this piece, and thanks especially to the patrons who have supported research this glosses.